The overnight trading action of the S&P has a decisive edge. Did you know that a lot of the gain of the S&P happens at night? This provides a unique opportunity to build a trading system.

But is that edge still holding up?

The overnight edge of the S&P is something I’ve written about before. If you’re not familiar with it, you can check out the article, “The Overnight Edge.”

Here’s a quick refresher.

I put together a trading system to test the overnight edge by buying at the current close and closing out the trade at the next day’s open. So, our trade is in play during the overnight session. On the flip side, I’ve also tested holding a trade only during the day by buying at the open and selling at the close. If you want to dive deeper into the details, just head over to the article I mentioned earlier.

S&P Points During Overnight Since 2020

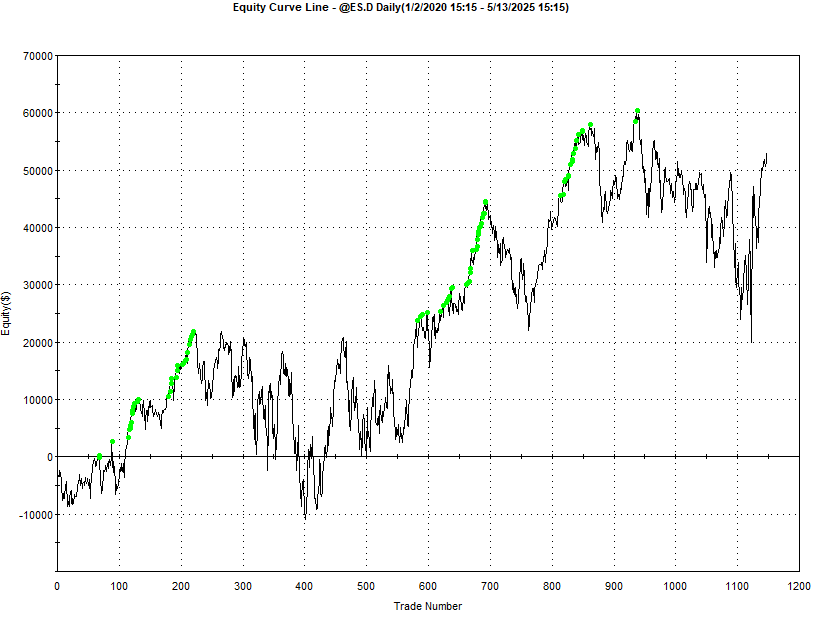

What I want to focus on is what has it been doing recently. So, let’s take a look at the results since 2020.

- January 1, 2020 to May 14, 2025

- No slippage or commission cost deducted.

- The symbol used was @ES.D.

So, let’s dive in and see what kind of action we can find during the day session. It’s always exciting to explore new possibilities and see if we can uncover some profitable patterns. Worst case scenario, we learn a thing or two along the way, right?

So, let’s dive in and see what kind of action we can find during the day session. It’s always exciting to explore new possibilities and see if we can uncover some profitable patterns. Worst case scenario, we learn a thing or two along the way, right?

S&P Points Gained During Day Since 2020

In contrast to the Overnight equity curve we can see new equity highs being made here. Thus, it looks like S&P gains are happening more often during the day session.Let’s put the results in a table to better compare.

Holding Overnight | Holding During Day | |

|---|---|---|

Net Profit | $44,562 | $53,037 |

Profit Factor | 1.08 | 1.07 |

Total Trades | 1147 | 1147 |

Avg.Trade Net Profit | $38.85 | $46.24 |

Max Drawdown | $50,250 | $45,325 |

NP vs. DD | 0.9 | 1.1 |

Let’s add a 200-bar simple moving average to act as a regime filter. We’ll take long trades only when price is above the 200-bar simple moving average.

Holding Overnight | Holding During Day | Overnight W/Regime | Holding Day W/Regime | |

|---|---|---|---|---|

Net Profit | $44,562 | $53,037 | $72,850 | $7,087 |

Profit Factor | 1.08 | 1.07 | 1.22 | 1.01 |

Total Trades | 1147 | 1147 | 850 | 850 |

Avg.Trade Net Profit | $38.85 | $46.24 | $85.71 | $8.34 |

Max Drawdown | $50,250 | $45,325 | $33,313 | $34,412 |

NP vs. DD | 0.9 | 1.1 | 2.2 | 0.2 |

Adding the regime filter did help the Night Session but it hurt the Day Session. Interesting! For the Day session we reduce the average profit per trade and the total net profit. On the other hand, with the night session we see nice improvements with the metrics.

Trading during the night session when the S&P is in a bull phase, looks promising. However, trading during the day does not look so hot. In short, this may suggest that the edge is in holding during the over night session.

Below is the equity curve of of taking long trades during the Night Session when the S&P is in bull phase.

What About Shorting?

With a little research I was able to test the optimal shorting is shorting the Day Session during Bear Markets (Below 200-day simple moving average).Below is a table containing the best shorting setup and the best long setup.

Short Day Session During Bear Markets | Long Night Session During Bull Markets | |

|---|---|---|

Net Profit | $28,288 | $72,850 |

Profit Factor | 1.13 | 1.22 |

Total Trades | 297 | 850 |

Avg.Trade Net Profit | $95.24 | $85.71 |

Max Drawdown | $20,250 | $33,313 |

NP vs. DD | 1.4 | 2.2 |

What Can I Do With This Info?

The above strategies are not trading systems. They are market studies to help point us in the right direction. They’re more like our trusty market compasses, pointing us in the right direction and giving us some clues about where we might want to focus our trading system-building efforts.The data is clear: since 2020, the S&P gains have tilted toward the day session, but only on the surface. Once we factor in market regime using a 200-bar simple moving average, the overnight session during bull markets becomes the standout performer—yielding a 2.2 Net Profit to Drawdown ratio and over $72K in net profits. That’s a dramatic improvement over the raw overnight edge or day trading alone.On the flip side, the best shorting opportunity appears in the day session during bear markets. This regime-aware approach reveals that profitable edges in the S&P aren’t just about time of day—they’re about context. The market environment (bull vs. bear) plays a critical role in whether the edge appears or vanishes.So what does this mean for the average retail algo trader?

- Divide and Conquer Your Strategy Design. Build separate systems for long and short trades—don’t lump them together. Focus your long entries on the overnight session during bull markets, and your short entries on the day session during bear markets. This alone can eliminate a ton of noise and increase strategy robustness.

- Use Market Regime as a Gatekeeper. A simple 200-bar moving average filter turned a mediocre strategy into a high-performing one. This is a powerful reminder: market regime filtering is not optional—it’s essential. It sharpens the edge and smooths the equity curve.

- Reconsider When You Trade. Most retail traders default to day session strategies because that’s when markets are “active.” But this study shows that some of the most profitable, lowest-drawdown opportunities exist when you’re asleep. A VPS and automated execution can help you capitalize on this overlooked edge.

- Non-Obvious Opportunity: Portfolio Timing Allocation. If you’re building a portfolio of systems, you might consider **segmenting exposure based on session and regime**, rather than spreading capital evenly. For instance, overweight your portfolio toward the long overnight strategy when in a bull market, and shift exposure to short day strategies during bear markets. This dynamic capital allocation could significantly enhance returns and reduce drawdowns.

The takeaway? Don’t just build “an S&P strategy.” That’s too vague. Build for session and regime. You’ll uncover edges others ignore—and in a market as competitive as the S&P, that might make all the difference.